You can pay a cash allowance to an employee for travel between home and work. Leave Travel Allowance LTA.

Ch19 Kieso Intermediate Accounting Solution Manual

You went on a business trip and you paid for your own lodging and travel on your credit card before requesting reimbursement through your business.

Are travel allowances taxable income. These combined allowances will be treated as a taxable travel allowance. Out-of-town travel allowance. If it is not reasonable the allowance has to be included in your employees income.

The following payments do not fall under per diem allowance and are not taxable. Allowances folded into your employees salary or wages are taxed as salary and wages and tax has to be withheld unless an exception applies. Leave Travel Allowance The Income Tax Act 1961 offers several tax saving options to the salaried employees apart from different deductions like LIC premium the interest of housing loan etc.

Is a car allowance considered taxable income. This payment is usually made when employees travel overseas to meet clients or to attend training and conferences. Further while fixed amount of transport allowance is exempt irrespective of actual expenditure conveyance allowance only to the extent of actual expenditure incurred is exempt from tax.

Are working outside their normal hours of work such as overtime shift or weekend work. The employee should claim a travel deduction on hisher personal income tax return. For more information see paragraph 48 in Interpretation Bulletin IT522R Vehicle Travel and Sales Expenses of Employees.

The travel allowance deduction operates on the premise that an allowance is included in a persons taxable income see section 81ai of the Income Tax Act to the extent that the allowance has not actually been expended on business travel see section 81aiaa. This is tax free if it reimburses their additional transport costs and they. The Tax Office publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee.

Must be withheld on the 80 of employees travel allowance. If the nature of a per diem allowance is as per Section 1014 of the Income Tax Act along with Rule 2BB of the Income Tax Rules then the per diem allowance shall not be included in the Total Income of the employee for the purpose of calculating tax on salary. The travel allowance deduction operates on the premise that an allowance is included in a persons taxable income see section 81ai of the Income Tax Act to the extent that the allowance has not actually been expended on business travel see section 81aiaa.

Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. A travel allowance provided by an employer is not taxed under the FBT regime but may be taxed under the PAYG withholding regime as a supplement to salary and wages. The company can only provide a part of the fare and the balance amount is taxable.

The general taxing principles of a travel allowance and a reimbursive travel allowance. Where a travel allowance is paid in addition to a reimbursive allowance see discussion below or vice versa both the amounts will be combined on assessment by SARS. A reimbursive travel allowance might be a taxable or non-taxable allowance.

It is partially exempt us 10 13A and the remaining amount is taxable. On one hand where deduction is something that is reduced from the total taxable income of an employee. This amount doesnt change regardless of how many miles he drives.

Per diem allowance while on business travel is non-taxable. Reimbursive travel allowances are not subject to PAYE but may be taxable on assessment ie. He receives 200 a month to compensate him for his use of his own car for his door-to-door sales.

The above amounts are reduced by. If the travel allowance is reasonable you do not have to include it in your employees income. When the necessary returns are submitted to SARS.

The allowance is meant to cover certain living expenses incurred overseas such as the cost of meals transport and other incidental items like laundry. Employees dont have to pay taxes on a car allowance if its a part of an accountable plan. It is offered for an employee for travelling anywhere in India for the company purpose.

Travel allowances provided for transfersbusiness trips are included in taxable income on amounts exceeding EUR 4648 per day transfers within Italy or EUR 7747 per day transfers outside of Italy if no meal and no accommodation costs are reimbursed. Josh is a traveling salesperson for Tables R Us. If you receive compensation through an allowance for an expense not related to your work you may have to claim it as taxable income.

Did you pay specifically for a business-related expense.

Big Money A Professional S Guide To Financial Freedom Financial Freedom Big Money Financial

Travel Allowances Capital Gains Tax Traveling By Yourself Tax Deductions

Ch19 Kieso Intermediate Accounting Solution Manual

The Income Tax Department Has Changed Rules Related To Exemption On Conveyance Allowance For Those Opting For New Income Tax Slabs Income Tax Income Allowance

11 Steps To Setting Up As A Sole Trader Self Employed Post 8 Of 10 Business Bank Account Business Expense National Insurance Number

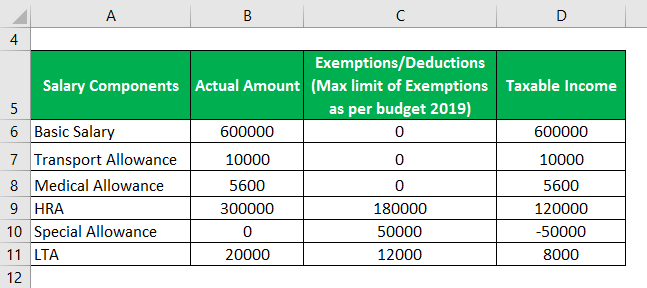

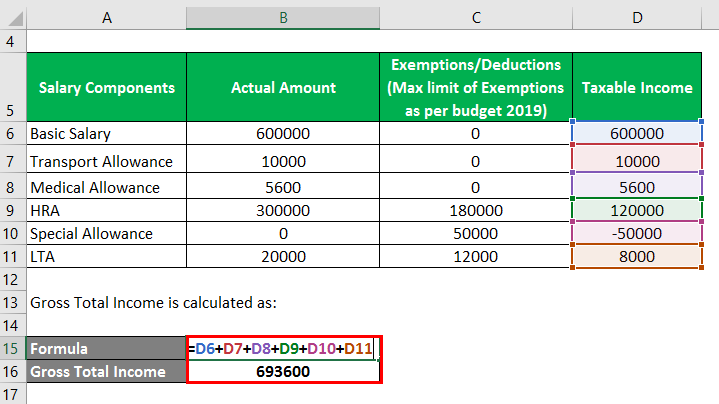

Taxable Income Formula Calculator Examples With Excel Template

Important Allowances And Their Questions Taxability Of Allowances

Taxable Income Formula Calculator Examples With Excel Template

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Tax Help

Automate Your Bookkeeping To Simplify Tax Time Bookkeeping Bookkeeping Services Bookkeeping Course

Taxable Income Formula Calculator Examples With Excel Template

What Is Per Diem The Per Diem Allowance Is Paid By The Employer To Its Employees For Lodging Meals And Incidental Expenses Incurr Per Diem Diem Cost Of Goods

Ch19 Kieso Intermediate Accounting Solution Manual

Ch19 Kieso Intermediate Accounting Solution Manual

Ch19 Kieso Intermediate Accounting Solution Manual

Taxability Of Allowances Under Income From Salary

Ch19 Kieso Intermediate Accounting Solution Manual

0 comments